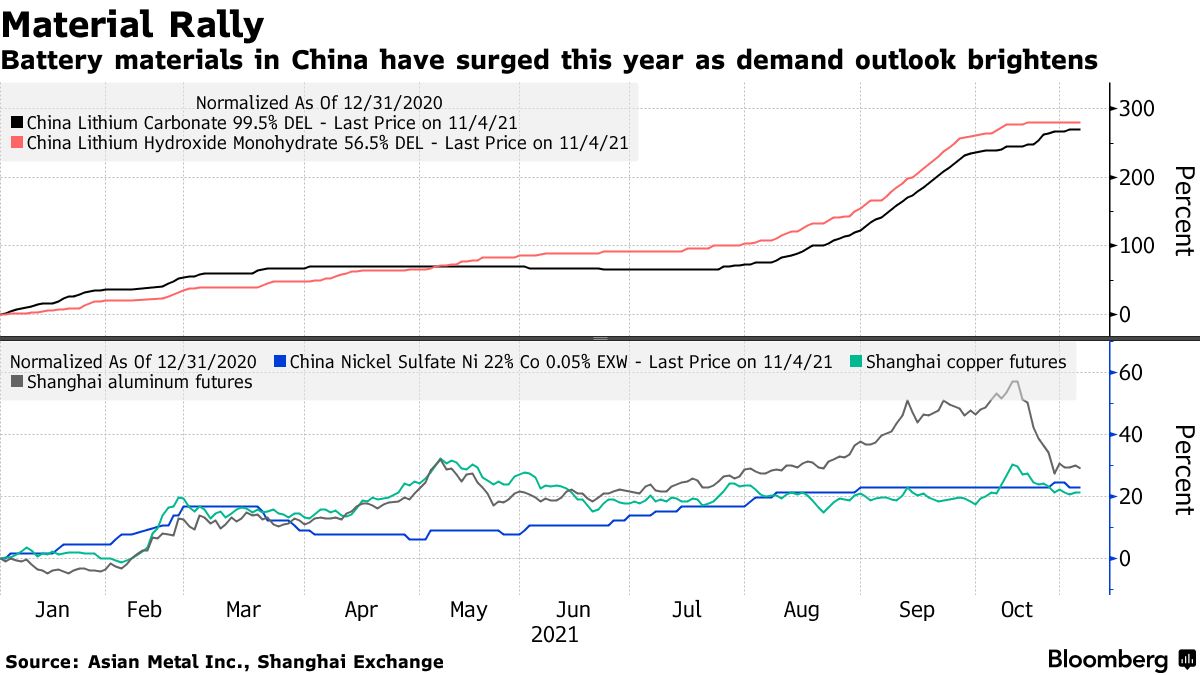

Battery raw material costs have been witnessing a whooping hike over the past few months due to a combination of ever-growing demand for mobility and stationary uses and supply bottlenecks. Such hike was directly translated in recent announcements made by large battery manufacturers such as BYD, Gotion High-Tech or other smaller ones like Guangzhou Penghui Energy Technology and Jiangxi Zhongzi Energy.

In late October, BYD announced a minimum 20% increase in battery costs due to higher raw material costs with a potential cancellation of older unexecuted contracts, according to The Securities Times citing a company notice [1]. According to the same notice, lithium carbonate (LiCoO2) prices jumped by more than 200% in 2021 from 2020-level values, electrolyte and anode (negative electrode) material costs by 150 % and anode supply has been limited.

According to multiple sources (Shanghai Metals Market, Chinese media), the following price hikes were observed: [2]

- Lithium carbonate: 192,500 yuan/tonne (30,174 USD/tonne) on October 25 - +263% since the beginning of 2021

- Potassium hydroxide: 180,000 yuan/tonne (28,215 USD/tonne) in October - +200% since the beginning of 2021

- Cobalt: more than 380,000 yuan/tonne (59,565 USD/tonne) in October - +60% since April 2021 (240,000 yuan/tonne)

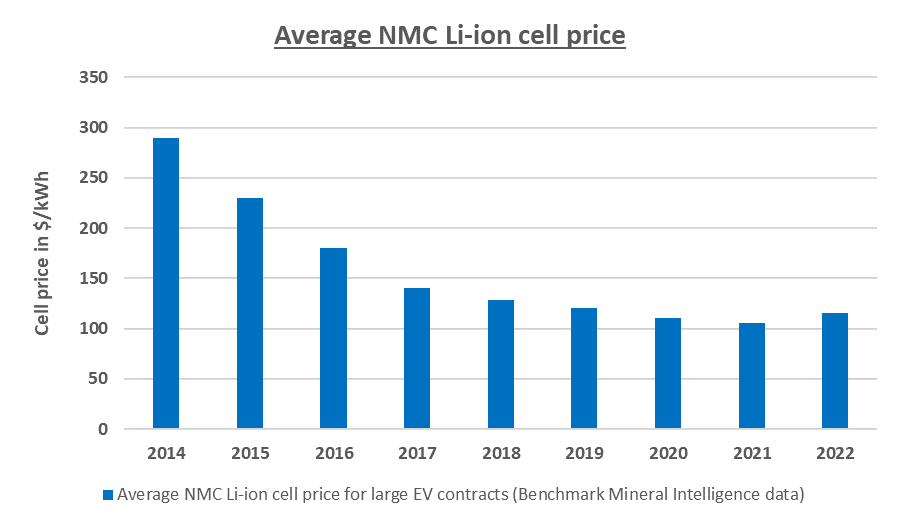

Despite great manufacturing cost reductions in the gigafactory era, raw material costs have a non-negligible impact on battery prices

First things first: lithium carbonate vs. lithium hydroxide

Both lithium carbonate and lithium hydroxide are precursors in the battery manufacturing process. They can be produced from brines, hard-rock deposits or clay-based lithium deposits.

Lithium carbonate is a lithium-based compound that combines with carbonate to form a salt. It is used as primary compound to produce cathode and electrode components. It is also used in the production of cement densifiers, glass, adhesives, aluminum and sealers as well as some medications – hence reflecting high demand levels.

Lithium hydroxide has been witnessing a growing uptake over the past few years as it is required to produce cathodes for high-performing EV battery chemistries such as NCA (Nickel-Cobalt-Aluminum) or newer NMC (Nickel-Manganese-Cobalt) chemistries. It decomposes at lower temperatures, making the cathode production process more sustainable. Given that lithium hydroxide is still being produced from brine, overall production costs were higher than lithium carbonate ones. New technologies aim for a direct extraction from spodumene rocks instead of brines to reduce such costs.

However, observed market prices over 2021 did not allow for such a simple relation for each of the two products. In fact, lithium carbonate prices have been surpassing lithium carbonate’s: that is mostly due to higher demand for the former given its multiple uses. The shift to lithium hydroxide production from spodumene will probably lead to higher market volatility.

The current battery chemistry adoption habits have also had an impact on this consequence. LFP batteries have been dominating the Chinese cell production, adding more stress on lithium carbonate needs. Based on Benchmark Minerals data [3], LFP batteries have had a 51.1% market share in 2021 (until October), an 8.5% increase from 2020 (42.6%). This increase was promoted by technological advancements of the LFP cathode chemistry as well as indirect governmental support.

Expected levels of battery cells increases

Based on data provided by Benchmark Minerals, battery cell prices are expected to bounce up in 2022 by 10% compared to 2021 prices, reaching a 115 $/kWh (for NMC).

No public data has been made available for lithium-iron-phosphate (LFP) batteries yet, but price hikes are expected to be higher as this technology relies on the already stressed lithium carbonate supply in their manufacturing. That was shown by BYD’s 20% minimum price increase - insisting on the term “minimum” as additional restrictions are looming, coupled to widespread power shortages that block Chinese supply lines and lead to the shortage of raw materials.

Supply chain bottlenecks are pushing major players to an acquisition spree

Such events have also impacted upstream players such as cathode suppliers or raw material suppliers. Ganfeng Lithium, one of the world’s largest lithium suppliers, announced a 100,000 yuan/tonne (16,675 USD/tonne) increase to all lithium-based products. Ganfeng has been racing to acquire smaller players like Bacanora Lithium (lithium, Mexico) for 264.5 million USD and stakes in a lithium mine in Mali for 130 million USD.

Larger battery makers are trying to contain the lithium supply bottlenecks by acquiring lithium miners. Contemporary Amperex Technology (CATL) has been quite busy as it:

- acquired Millennial Lithium in September 2021 for 297 million USD (and outbid Ganfeng Lithium) [4]

- acquired a 24% share in China Molybdenum’s Kisanfu cobalt mine in the Democratic Republic of the Congo for 138 million USD (April 2021)

- purchased stakes in other miners: Neo Lithium (lithium, Argentina), North American Nickel (nickel, Greenland), Pilbara Minerals (lithium, Australia) [5]

Sources:

[1] https://kuaixun.stcn.com/cj/202110/t20211026_3795485.html

[2] https://www.yuantalks.com/chinese-electric-vehicle-battery-makers-hike-prices-amid-surging-costs/

[3] https://www.benchmarkminerals.com/membership/benchmarks-lithium-carbonate-prices-reach-new-all-time-highs/

[4] https://www.millenniallithium.com/news/2021/contemporary-amperex-technology-co-ltd-to-acquire-millennial-lithium-corp-in-an-all-cash-offer-for-cad377-million

[5] https://www.reuters.com/article/millennial-lithi-ma-catl-idUSL4N2QU467