As this year’s winter season commences with ongoing geo-political tensions that are affecting the energy supply chains across the world, many countries are being faced with higher power bills and challenges when it comes to the security of supply.

The Old Continent was not spared as tensions have been ever growing over the gas crisis, started with activity uptake following the COVID-19 episode and worsened with the ongoing conflict in Ukraine. Such tensions led to a reconsideration of coal and nuclear energy as solutions to gas supply limitations to maintain power supply, halt spiking inflation and industrial slowdown phenomena.

The hike of energy prices as fears of supply scarcity keep growing

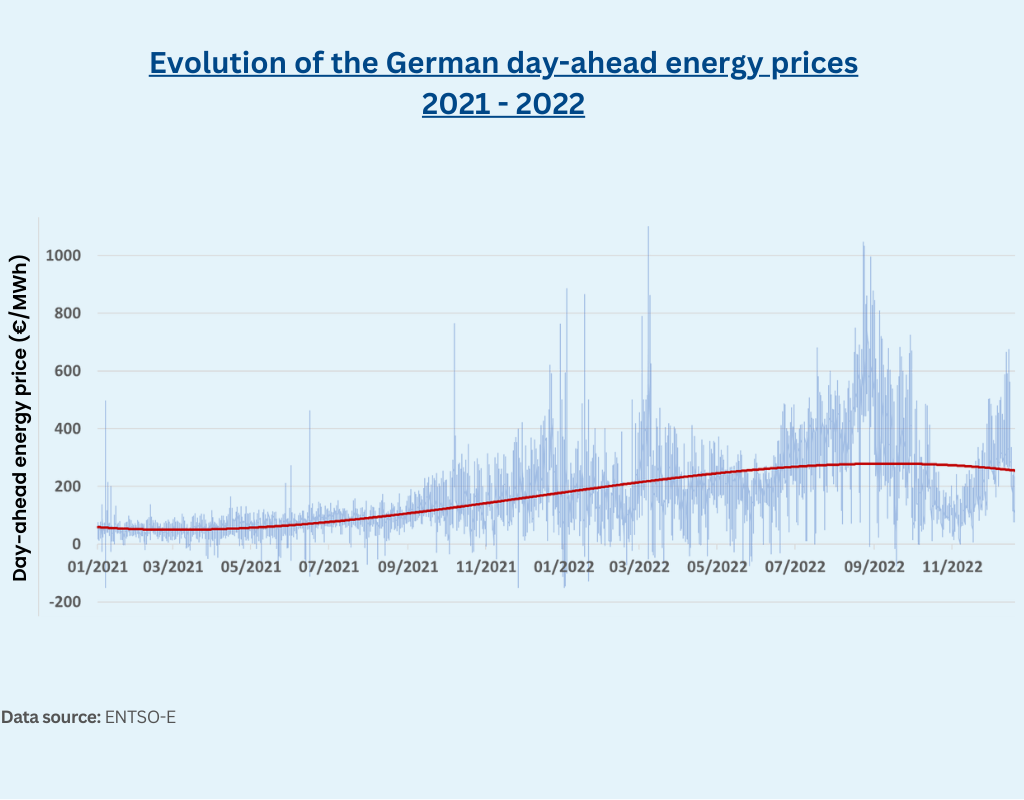

European energy prices have witnessed an increasing trend since mid-2021 as COVID-19 restrictions were alleviated, leading to an uptick in energy demand across different activity sectors.

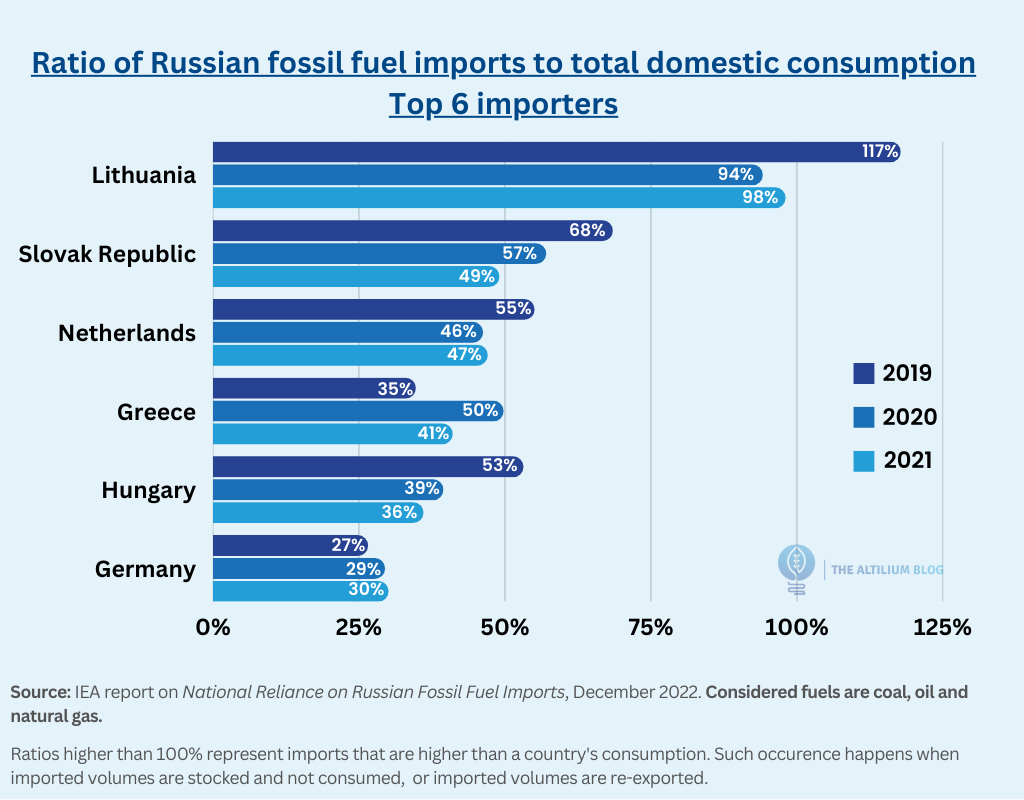

Added to that, the Russo-Ukrainian conflict has led to an accelerated price hike due to do fears of gas supply limitations – which are crucial for the energy and industry sectors across different EU countries as many rely heavily on imports from Russia.

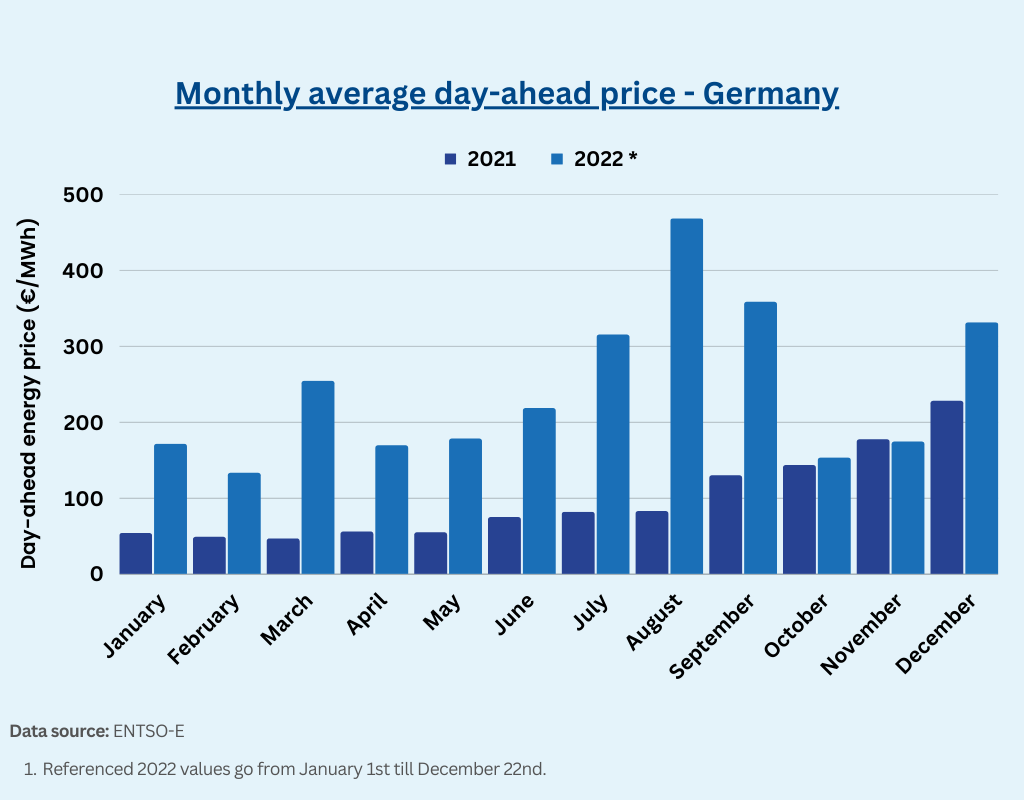

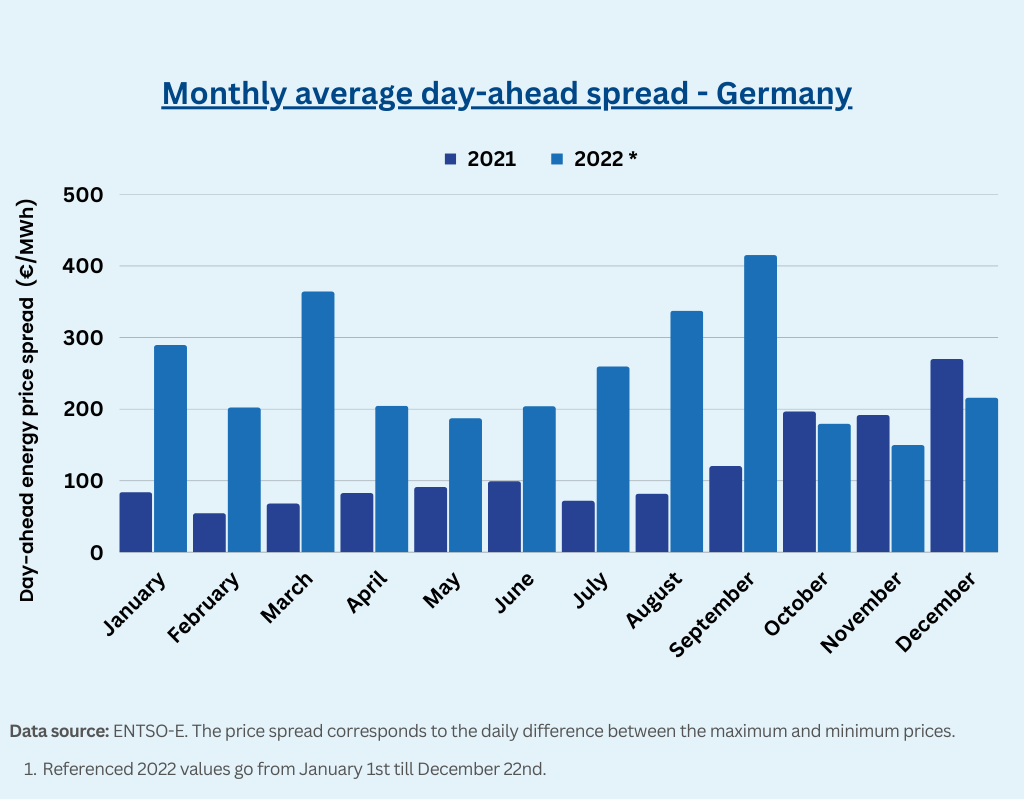

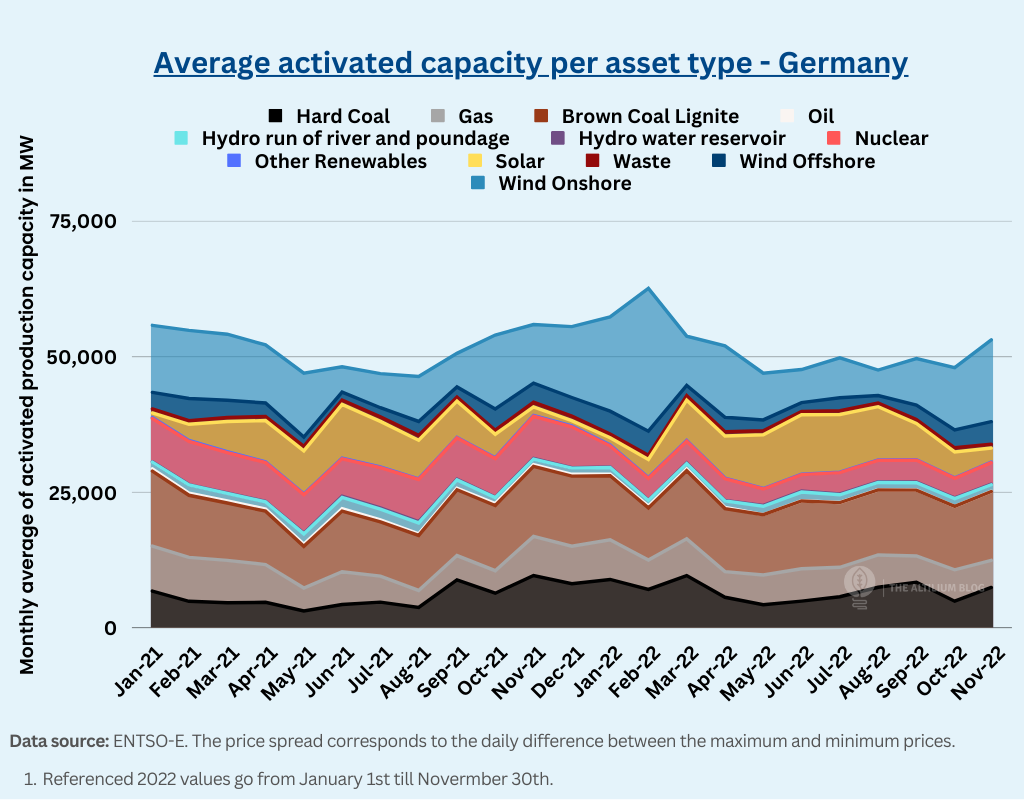

Germany was particularly affected given that Russian natural gas played a crucial role in its energy and industry sectors, some of the biggest in continental Europe. Said events led to high market volatility and considerable increases of the day-ahead energy prices over Q1, Q2 & Q3 2022 (shown in the graphs below).

The day-ahead electricity price reached a maximum of 1999.9 euros per MWh in March 2022, compared to a 764 €/MWh maximum in October 2021. Such trend has also affected daily price spreads as maximum recorded prices went up due to the cost increase of marginal generation assets that often are thermal-based (natural gas and coal).

As abovementioned, natural gas restrictions have pushed many European nations to reconsider their positions towards nuclear energy and coal. These elements are discussed in the following sections.

Coal: the rise from the ashes

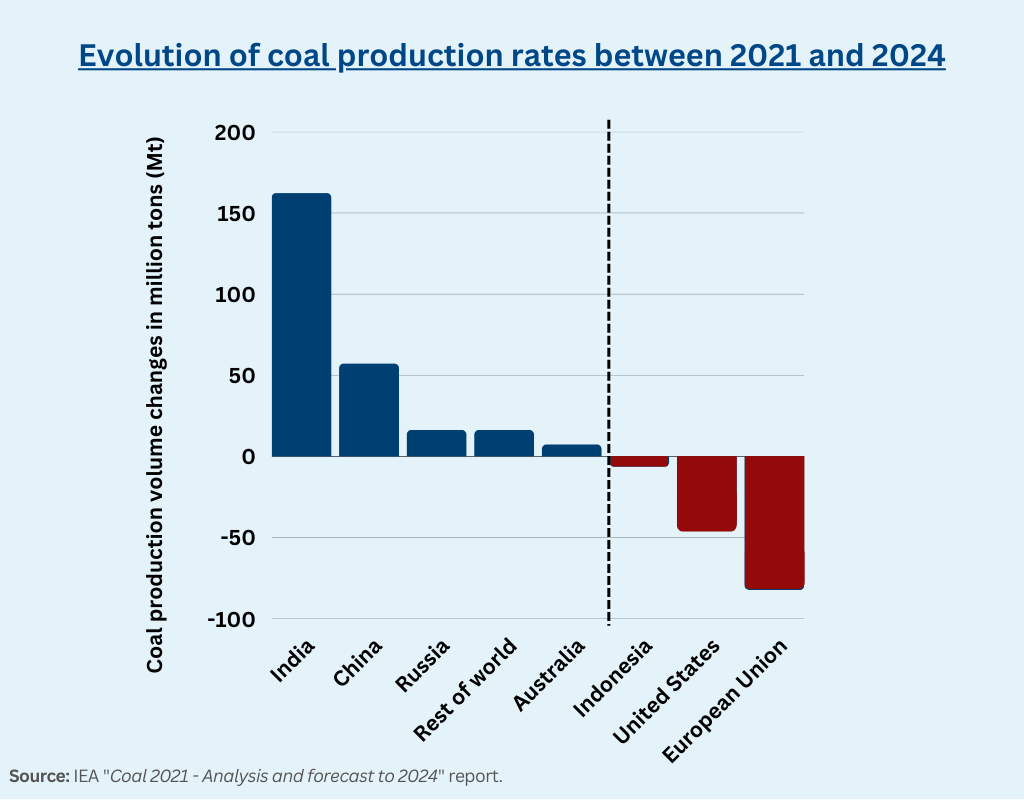

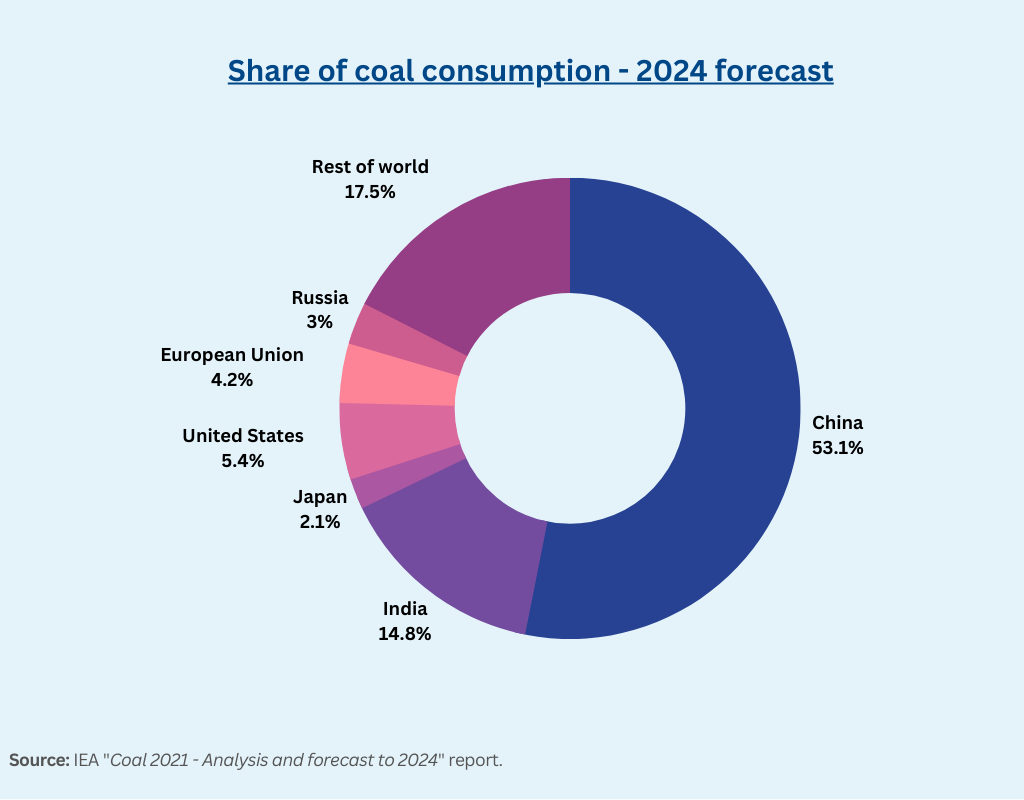

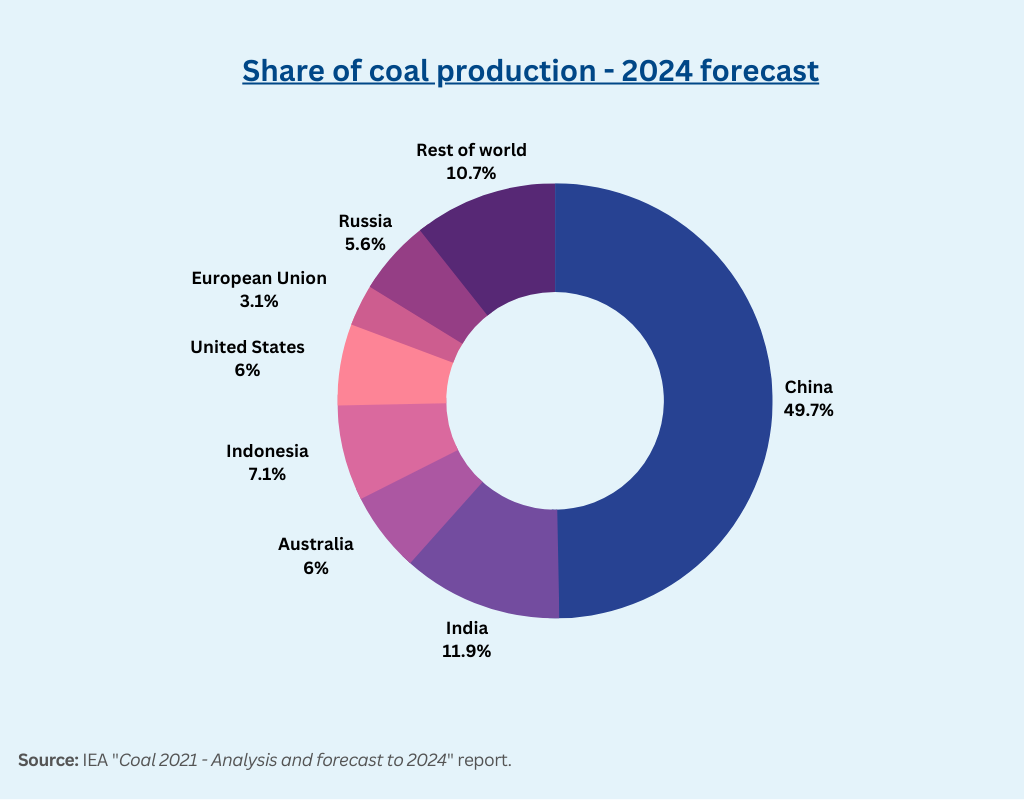

Based on data from the IEA’s "Coal 2021 - Analysis and forecast to 2024" report, China dominates the globe’s coal production (valued at 7,889 million tons in 2021) with a share of 50%, followed by India (10%), United States (7%), Indonesia (7%), Australia (6%) and Russia (5%). The ranking is set to remain the same as the forecasted production volumes are set to be growing up to 8,014 million tons by 2024.

Such uptick in coal production is justified by the fact that coal is still considered as a main energy source in many countries across the world, mostly by its main producers.

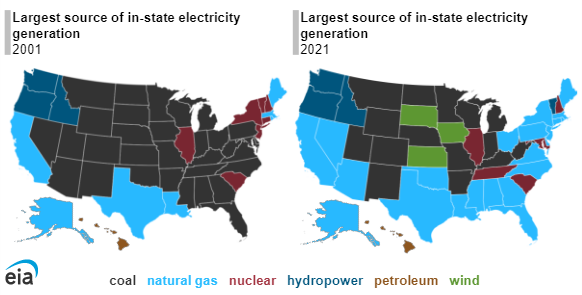

For example, although many states in the USA have managed to shift away from coal as the main power source over the past two decades, coal was still the primary resource for 15 states in 2021 (as shown in the image below, courtesy of the U.S. Energy Information Administration). Four of these states sourced more than 70% of their power needs from coal: West Virginia (91%), Missouri (75%), Wyoming (74%), and Kentucky (71%).

The European stance regarding coal has witnessed an undesired turn, especially in the European Union where the retirement of coal plants was considered a primary target over the 2030 horizon. Earlier this year, the German Minister of Energy unveiled a plan to revive and increase the output of existing coal power plants (up to 10 GW) as gas reserves are threatened by the Russo-Ukrainian conflict and their use will be dedicated to other activity sectors. Such decision has had a clear impact on activated power reserves as the average activated capacity over the January-November 2022 period was of 6.85 GW for hard coal (5.9 GW in 2021) and 11.7 GW for brown coal lignite (11.2 GW in 2021). The graph below gives a representation of these trends.

Neighboring France “resuscitated” the 1,200-MW Saint-Avold coal plant after it was taken out of service on March 31st as part of an engagement to decommission all coal plants by the end of 2022 – making a total of two coal plants that are currently operational in France (the other one being the 1,200-MW Cordemais plant).

Italy, Austria and the Netherlands will also be following suit to prevent a winter supply shortage of natural gas. For example, the Dutch government removed a cap that previously limited coal plants’ output to a third until 2024. If current measures were to be insufficient to cover the entirety of other sectors’ gas needs, local governments will have to restrain consumption in other sectors such as the industry, transportation or even residential heating – restrictions with a potentially sensible impact on such countries’ economies in addition to the growing inflation.

Such measures are seen as grave threats to the pathway to fully exit coal in Europe by 2030 at the latest as no solutions to the ongoing crisis loom in the horizon and many European governments were caught unprepared: extensive delays in the application of renewable energy strategies (or the lack of such strategies) pushed towards such backslide. Added to that, the need for coal is leading to controversial announcements such as the approval of a new coal mine in the UK [1] – the first in 30 years – or the dismantlement of a wind farm near the town of Lützerath to make place for an expansion of the Garzweiler coal mine [2].

Nuclear energy back to the scene: a love-hate relationship

While accelerated efforts and attention have been pouring over energy storage and green hydrogen as short- to medium-term solutions to reduce the dependency on imported energy resources (to be discussed in another article), nuclear energy has been gaining some traction.

The ongoing crisis has altered plans that many EU countries had regarding nuclear power retirement over the 2030 horizon.

Some of the most interesting examples:

- Belgium’s government approved the extension of operations at the Doel 4 and Tihange 3 reactors to 2035 instead of their initial decommissioning set for 2025. Such decision will retain 2 GWe of nuclear generation capacity. [3]

- Germany's three remaining reactors - Emsland, Isar 2 and Neckarwestheim 2 – that have a combined capacity of 4GWe were set to be permanently shutdown at the end of year of 2022. However, the national Cabinet has approved an extension of operations till mid-April 2023 to ride out the winter. These units help avoid 25 million tonnes of carbon dioxide emissions per year. [4]

- The most recent case is the Netherlands' as it just announced plans to build two new nuclear plants by 2035 to cover up to 13% of domestic power production. The total budget of said plan was set at 5 billion euros. Both plants are set to be sited close to the sole existing plant: the 482-MW Borssele one. [5]

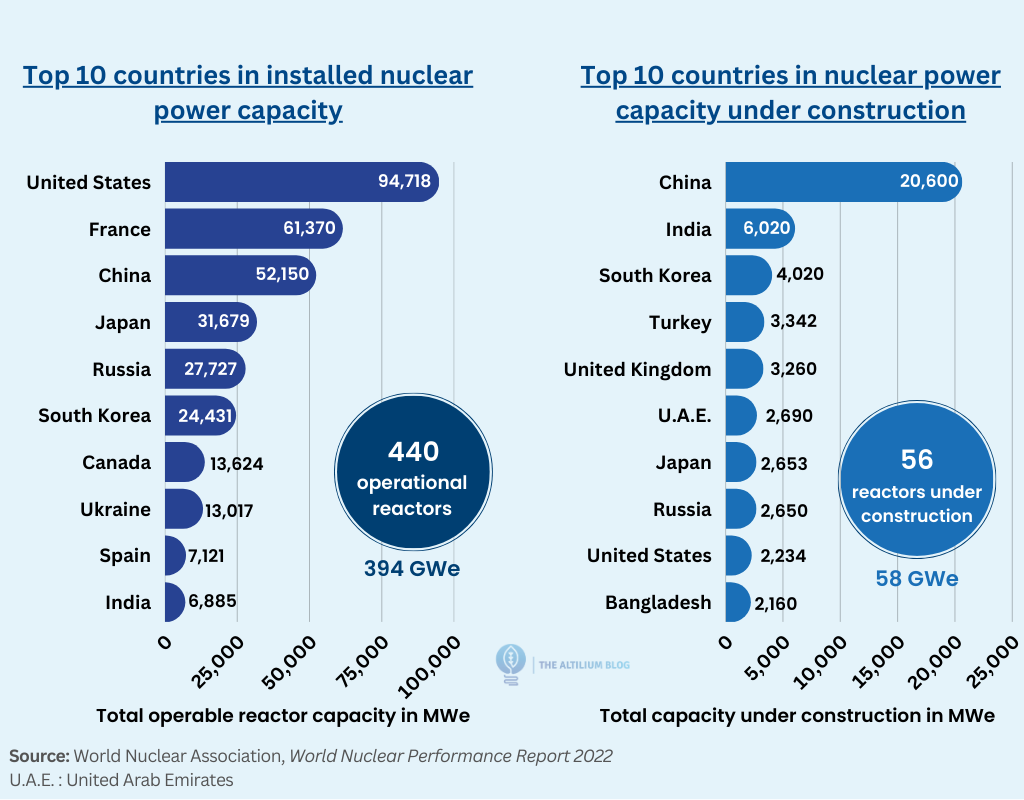

On an international level, 58 GW of nuclear power capacity are currently under construction with China in the lead, followed by India and South Korea. An approximate capacity of 394 GWe is currently operational, led by the United States, France and China (based on values indicated in the World Nuclear Association’s World Nuclear Performance Report 2022).